If you are a Texas resident and cannot keep up with the minimum payments due on your credit cards, then I have some good news!

We’re talking about UNSECURED debts like:

- Credit Cards (Visa, Master Card, Discover, etc.)

- Store Cards (Kohls, Home Depot, Lowes, etc.)

- Personal loans with no collateral

- Private Student Loans

- Medical Bills

- Quick Pay or “Pay Day” loans

If you find yourself in a situation where you just cannot keep up, then what happens?

You will start getting calls, letters and emails from the creditor trying to get you to start making payments again.

You would think that if you could just “explain your situation” the agent would understand, but this is rarely the case!

After helping people deal with debt for over 20 years, I think is is better to not speak with the agent and of course, not to call back if they leave a voice mail.

Same with emails, just ignore for now.

Why?

After a month or so of unsuccessful attempts (calls, letters, emails), your account will most likely be transferred to the internal collections department or sold to a debt collector.

Well, now the calls, letters, and emails will start again!

But now that your account has been transferred, you can stop the calls:

After a few more months, a creditor, collector or debt buyer could decide to retain a law firm that specializes in debt collection to file a CLAIM.

A claim is filed with your local county courthouse and you will then receive a SUMMONS.

The summons will basically state that the creditor (PLAINTIFF) claims that you ( the DEFENDENT) owes a certain amount of money claimed.

The summons will also state that you have 30 days (varies a little from state-to-state) to APPEAR and give an ANSWER.

It sounds like you will have to go to court and stand before a judge to explain yourself!

NOT SO!

It means that if you can PROVE with UNDENIABLE PROOF that you do not owe the CLAIMED debt, you have 30 days to file the proper papers with the court.

If not, then the Plaintiff may petition the court for a DEFAULT JUDGMENT.

NOW WHAT????

Only after a judgment is awarded (usually will take 4-6 weeks after the summons is served) the Plaintiff can have the attorney file a claim for WAGE GARNISHMENT.

HOWEVER….

If you a resident of the great state of Texas, your wages CANNOT be garnished!

In most other states, the court can approve a wage garnishment and your employer would have to send 25% (average per state) of you NET, TAKE-HOME to the creditor or attorney for the creditor!

But again, NOT SO IN TEXAS!

Does that mean that you can just forget about your debts?

NO! Please understand…

A creditor may not be able to garnish your wages, but they can have their attorney apply to the court for a writ of LEVY ON YOU BANK ACCOUNTS!

That means that you could try to use your debit card or write a check and find out there are no funds available!!!

So what can you do?

Once you account(s) go to “collections”, you may be able to negotiate a SETTLEMENT for less that the full balance.

But you need to do this BEFORE A JUDGMENT IS AWARDED!!!

Yes, you can negotiate a repayment plan after a judgment has been awarded, but it is difficult to do so.

If you can get to the creditor, collector or debt buyer before legal action starts, then a SETTLEMENT can be negotiated.

A SETTLEMENT is an agreement between you and the creditor or owner of the debt to repay a certain percentage of the balance due.

Once the agreement is completed, the account is now considered “paid-as-agreed” or in some cases “settled for less than the full amount”.

Either way, the account now has a $0 balance and believe it or not, you credit score will start to improve!

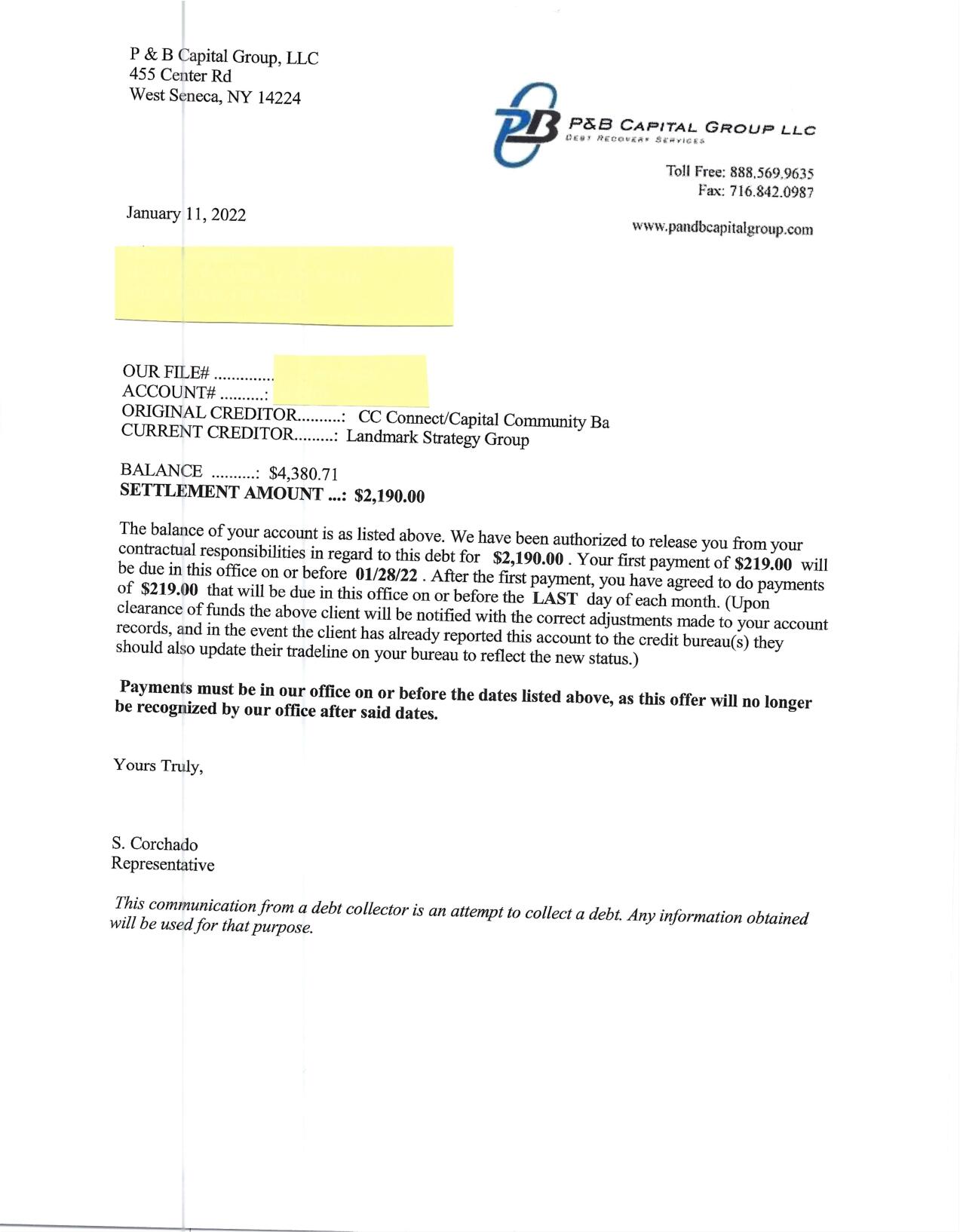

Here is an actual example of a settlement we negotiated for one of our clients recently:

Some settlements may be higher or lower, depending on the circumstances, but a decent settlement should be around 50%-60%.

I hope this has been helpful.

To recap:

- If your unsecured debts are only a month or so delinquent, then they are most likely not going to be open for settlements.

- But, after 4-6 months (can vary), your accounts should be able to be negotiated for a settlement.

- REMEMBER…DO NOT IGNORE A SUMMONS! Just because your wages cannot be garnished in Texas, you bank account could be levied!

Leave a Reply

You must be logged in to post a comment.