You do not have to put up with debt collection harassment, but you need to know your rights under the Fair Debt Collection Practices Act in order to put a stop to it!

Our nation's consumer protection agency is call the Federal Trade Commission or FTC. This agency enforces the Fair Debt Collection Practices Act or FDCPA. The FDCPA was designed to put a stop to abusive and unlawful attempts by debt collectors to collect debt.

Debt Collectors are strictly prohibited from using unfair or deceptive techniques in their debt collection activity.

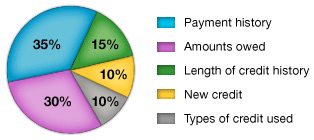

Not all debts are covered by the FDCPA. The act covers basically all debts, such as:

- personal loans

- credit cards

- store cards

- medical bills

- student loans

- mortgages

- auto loans

The FDCPA does not include debts you may have incurred in order to operate a business.

So, what happens if you find yourself in a financial situation where you can no longer meet the terms of your loan or credit account?

Once your account has been charged off by the original creditor and placed with a collection agency, the telephone calls will start. This is the most abused type of debt collection activity, but you have rights that you must not only be aware of, but take advantage of!

Unless you agree to it (and who would), a debt collector cannot call you before 8am or after 9pm. They also are prohibited from calling many, many times during the day. Many debt collection agencies use an automated dialer to make thousands of calls a day, hoping to catch someone.

Here is some good advice on how to deal with a debt collector's call:

If you have the address of the debt collector (from one of the many letters you have no doubt received by now), then don't answer. Your caller ID should indicate an "unknown" number or a number that is certainly not one of your family or friends.

If you (or perhaps one of your family should answer by mistake), briefly tell the debt collector that you are working on the problem and will get back to them...then HANG UP!

REMEMBER...Debt Collectors are professionally trained to get you to agree to pay back your debt right away! Trying to explain your circumstances hoping for some understanding and/or sympathy is usually a waste of your time.

If you don't have the address of the debt collector (I'll explain why in a minute), then ask for it from the debt collector or at least get the debt collector to identify the company. Now, you can go on line to get the address...WHY?

Because the FDCPA specifies that once a debt collector has received a written demand to stop placing calls to you, they must stop! They are allowed one more call to tell you they got your letter and will not call again or that they intend to take further legal action in an attempt to scare you into...yep...giving them money!!!

In most cases, the debt collection agency will honor your demand letter and stop calling you. That doesn't mean that you are not still responsible for the debt, but at least they will stop call you.

What about calling you at work?

A debt collector is also prohibited from calling you at your place of employment if they are told orally or in writing that you are not allowed to receive calls at work. Again, most of the time, they will honor your request.

What about calling your family or neighbors?

Yes, but only to find out a little information about you:

- Do you still live at....

- Is your phone number still....

- They may ask about your place of employment as well.

But, they may not discuss your financial situation!

I'll discuss what you can do if they are violating the FDCPA in just a minute, but here are some other basic practices or techniques that are also prohibited by debt collectors:

They are prohibited from...

- using threats of violence or harm (but, after a dozen years in dealing with debt collectors, I have never heard of this violation)

- using obscene or profane language

- making false statements, such as claiming to be an attorney or representing the government

- making statements such as "you may go to jail" if you don't pay!

threatening to garnish your wages or seize your property if, in fact, they have not been awarded a judgment after several months of legal efforts.

threaten to take legal action if, again, they don't follow through

OK, so what can you do if you feel that a debt collector has violated the Fair Debt Collection Practices Act?

First, contact your State's Attorney General's office to file a complaint. Usually, the best way to do this is to go on line.

For example, in Oregon, you can file a complaint at:

Oregon Department of Justice Consumer Protection

Next, you will want to file a complaint with the Federal Trade Commission.

Your state's attorney general's office as well as the Federal Trade Commission doesn't take abusive debt collection practices lightly! In fact, you have a right to sue a debt collector in a state or federal court within one year of the violation.

If you plan to do so, you should consult an attorney.

Finally, dealing with debt collectors is no fun and is certainly not easy. But, knowing your rights can really help.

Need mor advice? Let us help:

Photo Credit:

https://www.flickr.com/photos/sovietmole/