Is there anything you can do about credit report errors?

Is there anything you can do about credit report errors?

YES! If you find errors, you can contact the three main credit reporting agencies:

-

Equifax

-

Transunion

-

Experian

Equifax (800) 238-8067Mail to:Equifax DisputesPO Box 740256Atlanta, GA 30374-0256

______________________

Experian (714) 830-7000

Mail to:ExperianAttn: Disputes475 Anton Blvd.Costa Mesa, CA 92626________________________

TransUnion (800) 916-8800Mail to:TransUnion Consumer solutionsPO Box 2000Chester, PA 19022-2000What do you need to dispute a Credit Report Error?

- A statement or settlement letter from the creditor showing that the account balance was paid or settled-as-agreed

- A copy of the canceled check proving payment was received

Follow up in about 2 weeks if you do not receive any confirmation that the error has been corrected.

BEWARE OF COMPANIES THAT CLAIM TO BE ABLE TO CORRECT ERRORS AND IMPROVE YOUR CREDIT SCORE! ! !

The Federal Trade commission (FTC) has good information on how to correct credit report errors. CLICK HERE

For a FREE Credit Report, go to www.annualcreditreport.com.

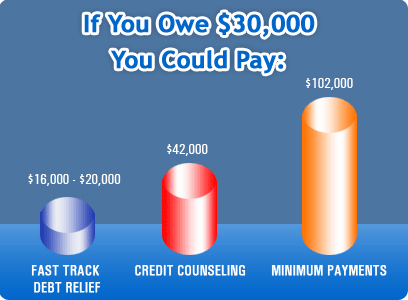

If you need professional help, we have been helping clients for almost 10 years to settle debts for much less than they owe!

For mor information on fixing Credit Report Errors or to get help eliminating your debt, Give us a call!

1-877-492-4109

or Click on the link below