Before you pay for "Credit Repair", you need to know what is FACT and what is FICTION!

Beware of claims from so-called Credit Repair Companies like:

- We will remove negative items, bankruptcies, judgments, liens from your credit report!

- Improve your credit score by 50 to 100 points!

- Erase all bad credit...guaranteed!

- Create a new identity!

Sound a little too good to be true?

No one can LEGALLY remove correct or accurate information that is reported on your credit report.

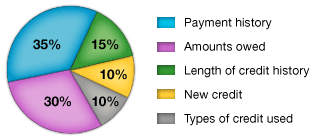

After all, a credit report is a recorded history of how you have used credit. There are many factors that go intor formulating a CREDIT SCORE.

There are three major three Credit Reporting Agencies:

Although each uses a slightly different set of criteria for determining and assigning a credit score, they are basically the same.

Although you cannot remove accurate information from your credit report, YOU CAN HAVE INACCURATE INFORMATION REMOVED!

We are all entitled to receive a FREE CREDIT REPORT annually. I believe it is a very good practice to request your credit report each year to make sure there are no mistakes or inaccurate information being reported!

You are also entitled to receive a copy of your credit report used by a company that denied your application for:

- Credit

- Insurance

- Employment

You have to request it within 60 days of receiving notice of denial, so don't wait too long!

If you find errors or inaccurate information on your credit report, you can dispute it with the credit reporting agencies (yes, you may have to contact all three is the same information appears on each credit report).

You can either write a letter or go to the credit reporting agencie's website. I believe going on line is the most efficient way to dispute items.

You will need to have:

A copy of the errors on your credit report. You don't have to send or include the entire credit report. Just circle the items you are disputing.

Next, you must explain or prove why your are filing the dispute.

For example:

Let's say that you had a credit card that was completed paid off a few months ago and the credit report is still showing a balance.

You will need a canceled check or bank statement showing the payments or series of payments to the credit card company. You may be able to get a copy of a letter or statement from your credit card company by calling or going to the credit card company's website.

Make a copy (.pdf if filing on line) and include with a brief statement of why this item should be corrected.

For example:

I am opening a dispute about the account I have circled on a copy of my credit report with your company.

As you can see from the attached (or enclosed) statements, canceled check(s) and/or bank statements, this account has been paid in full.

Please make this correction as soon as possible.

Thank you,

(your name)

- Not only does the credit reporting agency have to correct the error, IF YOU REQUEST, they must send a copy of the corrected report to anyone who got your report over the last 6 months!

- If the error caused you to not get the job you applied for, again, IF YOU REQUEST, the credit reporting agency must send a corrected copy to anyone who got a copy for employment purposes over the last 2 years.

By law, the credit reporting agency must investigate your dispute within 30 days.

- They must send the information you provide in your dispute to the company reporting the inaccurate information.

- After they company investigates and reviews the proofs you included about the disputed item, it must report back to the credit reporting agency as well as all other credit reporting agencies.

- Once the investigation is complete, the credit reporting agency must provide you with the results and a free copy of your correct credit report.

What about negative information on your credit report?

Unfortunately, negative items on your credit report cannot "magically disappear", regardless of the claims of some credit repair companies!

But over time, these items will be removed.

- 7 years for most negative items

- 10 years for bankruptcies

- 7 years (in most states) for judgments

But what about those so-called "credit repair companies" that claim to be able to remove negative information?

Well, it's just not true. In fact, you should read an article from the Federal Trade Commission's website about one credit repair company's penalties, etc.

Many credit repair companies use the VALIDATION LETTER technique. While it is certainly legal and ethical to challenge inaccurate information on your credit report (as we discuss above), there are some (too many in my opinion) credit repair companies that ABUSE this technique.

The rationalization is that the credit reporting agencies are some overwhelmed with disputes that often they will just correct and/or remove the disputed item without doing a thorough investigation. After all, the credit reporting agencies are in business to make a profit.

So yes, maybe in some cases they will remove an item without much investigation, but the creditor reporting that information can (and most likely will) put the disputed information back on your report.

This type of CREDIT REPAIR FRAUD has caused many credit repair companies to be heavily fined or forced out of business over the last few years.

And yet, for those who feel they cannot make disputes themselves or would be willing to pay for legitimate credit repair services, there are many solid, credible companies. Check with your state attorney general's office for a list of registered credit repair companies and also with the Better Business Bureau for complaints.

Photo Credit: https://www.flickr.com/photos/brook_lands/

Is there anything you can do about credit report errors?

Is there anything you can do about credit report errors?