One of the most commonly asked question we get here at Debt Relief NW, Inc. is…

One of the most commonly asked question we get here at Debt Relief NW, Inc. is…

“When or at what point is bankruptcy my best option?”

For over 10 years now, we have been helping people avoid bankruptcy through debt settlement.

While debt settlement is not the answer to everyone’s financial problems, many times the traumatic and gut wrenching process of bankruptcy can be avoided through debt settlement.

When we interview someone to determine the best course of action based on their specific circumstances, there are basically 3 options for most people:

Debt Management

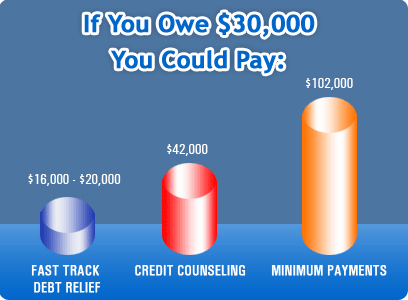

The credit industry figured out that if they only charge you a very small monthly minimum payment coupled with a large interest rate, late fees, over-the-limit fees and an annual account fee, they (the credit card company) would make 3-4 times the original amount they let you borrow!

The goal of the credit card industry IS NOT for you to pay off your debt!

The goal is for you to be paying small minimum payments for many, many years!

In a debt management program (sometimes still referred to as “credit counseling”), a person who is barely making the minimum payments on their credit cards and other unsecured debts (store cards, personal lines of credit, pay day loans, etc.) will enroll all of those debt with the debt management company.

They will usually be required to have a payment that is approximately 2.5% of their total indebtedness. For example, let’s say you have several cards and personal accounts that total $25,000.

In a debt management program, your single monthly payment would be approximately $600-$625 per month for approximately 4 years or so.

This is a great way to get your credit accounts under control and have a day in the future when you can finally be DEBT FREE!

But, what if you cannot afford the minimum payment required by a debt management company?

Debt Settlement Program

A prospect for a Debt Settlement Program usually fits into one or more of the following scenarios:

- They have too much debt and cannot keep up with the minimum payments.

- Some or all of their accounts have gone (or are about to go) to a collection agency.

- They cannot afford the payment required of a Debt Management Program.

- They want to avoid bankruptcy if at all possible.

In a Debt Settlement Program, your current creditors WILL NOT be receiving normal monthly payments.

Instead, your accounts that have become delinquent will be/or have been charged off and sent to a collection agency for collection.

After a thorough financial consultation, the debt settlement counselor will evaluate what you can reasonably afford to set aside monthly into a Client Reserve Account. As this account grows, the debt settlement company will be contacting you creditors and/or collection agencies to negotiate settlements.

Depending on several factors, settlements may be negotiated with a one-time payment from the funds accumulated in your reserve account or a term-settlement may be negotiated whereby the collector agrees to a reduced settlement paid out over a specific period of time.

Once the settlement agreement has been completed, the collection agency or creditor will contact each of the 3 major credit reporting agencies (Experian, Equifax and Transunion) to report that the account has been paid-as-agreed.

Over time, as your accounts are settled, you credit score begins to improve.

But what if you cannot afford much more that a small monthly deposit to the reserve account or nothing at all?

This is where Bankruptcy becomes a “tool” to protect you from creditors who choose to:

- Seek Wage Garnishment

- Levy a Bank Account

- Place a Lien on your property

If you are considering bankruptcy, you should consult one or more attorneys who specialize in bankruptcy.

Bankruptcy should not be viewed as a “get out of jail Free Card”, but rather the last and only option when faced with insurmountable debt.

When you have so much debt that you are not able to keep up with the minimum payments, your options are limited:

When you have so much debt that you are not able to keep up with the minimum payments, your options are limited:

Making the choice between BANKRUPTCY and DEBT SETTLEMENT can be a daunting task. The fact is, one is not the clear winner. The option you choose will depend on several factors.

Making the choice between BANKRUPTCY and DEBT SETTLEMENT can be a daunting task. The fact is, one is not the clear winner. The option you choose will depend on several factors. Just the word BANKRUPTCY sounds terrible! Before you decide if bankruptcy is best for you, here are 3 ways to avoid bankruptcy:

Just the word BANKRUPTCY sounds terrible! Before you decide if bankruptcy is best for you, here are 3 ways to avoid bankruptcy:

So you’re ready to get out of debt once and for all. The question is, how do you do it and what options do you have. I’m going to share the options available to you as well as the pros and cons of each.

So you’re ready to get out of debt once and for all. The question is, how do you do it and what options do you have. I’m going to share the options available to you as well as the pros and cons of each.