Would you like to know how to improve your credit score?

Would you like to know how to improve your credit score?

Here are a few very helpful tips you can use to do it yourself.

I've written several articles and blogs on the subject of Credit Repair, How to Improve Your Credit Score, How to Have Errors on Your Credit Report Corrected, etc. over the years.

When it comes to the subject of "CREDIT REPAIR", there are several misconceptions, but the most prevalent is that you can get the top three credit reporting agencies (Equifax, Experian or TransUnion) to remove negative information from your credit report.!

You may have seen ads from the newspaper, TV, radio, on line or phone making claims such as:

- "We can remove bankruptcies, judgments, liens and bad loans from your credit report!"

- "We can erase bad credit!"

- "We will help you create a new credit identity that is 100% legal!"

Credit Reporting agencies sell (that's right, they are in business to make a profit) your credit history to those who need to know that if they loan you money, you have (or have had in the past) the ability and track record to repay that loan!

Make sense? Sure. Then why would you think that you or some Credit Repair Company could magically make negative information disappear?

Yes, there are some credit repair companies who, in my opinion (and most likely your state's attorey general) have the methodology to have some negative items removed from your credit report for a short period of time or until the creditor realizes it and makes a claim to have it replaced!

Some people will pay a lot of money for this type of shady "credit repair" in order to get a loan or possibly qualify for an apartment or even for employment.

Be very careful of these claims! They could come back to haunt you!

The Federal Trade Commission has written many good articles on this subject and credit repair in general.

Here's a link to a very good article: CREDIT REPAIR: HOW TO HELP YOURSELF

OK, but what about LEGITIMATE ERRORS?

If you haven't done so already, you need a copy of your credit report (not necessarily your score at this time) from each of the top 3 Credit Reporting agencies.

If you have applied for credit, insurance or employment, and were denied, you can request a copy of the report, if you do it within 60 days.

You are entitled to a FREE CREDIT REPORT every 12 months. Just go to www.annualcreditreport.com or call 1-877-322-8228.

Carefully check all of information on all 3 reports.

Make sure you name, social security number, address, etc. are correct.

What you are looking for is accounts that you know (and can prove) that you have paid off.

Also, depending on your state's statute of limitations, negative information in the past (charge offs, accounts that you were late paying often, etc.) can be removed after a certain number of years.

For example, if you live in Oregon, the statute of limitations is 6 years on most accounts.

But, the biggest thing you are looking for is for accounts that you have paid off and are still showing a balance or may have been turned over to a collection agency.

Make a copy of your the page of the credit report showing the account you wish to dispute.

Gather the proof of payment:

- Letter or account statement with $0 balance

- Copies of check and/or money order you used (you may have to contact your bank or go on line)

- Letter of satisfaction if you paid off a judgment

Now, you are going to write a letter with this information to EACH OF THE 3 CREDIT REPORTING AGENCIES.

Yes, you can go on line and in many cases this works best, but somehow I think the "paper trail" of a letter with proof is more effective.

If you do not get a reply within 45 days, make sure to follow up! Don't GIVE UP!

This is where I think it may be a good idea to hire a professional, ethical credit repair company to do this for you.

Yes, it will cost you some money, but there is a lot of time and effort that will go into challenging several items and you may not want to spend the time.

Check with your state's attorney general's office for a list of good, reliable credit repair companies.

If you live in Oregon, click here for a list of registered companies.

Comment on the subject of Credit Report Disputes:

Recently, I had written a blog about this subject and received a comment from a Credit Repair Company owner.

The blog was titled "Best Options for Credit Card Debt Relief" in which I listed and explained several ways to help get debt.

He commented and asked the question why I did not explain how to "fight for non payment of a credit card" rather than file for bankruptcy.

I understand and apprecitate the comment, but in my opinion, if you or I agree to repay a debt by taking out credit, then we have given our word...made a promise to repay and should do so if at all possible.

I don't think it is right to try an find a loophole such as they fact that a debt collector (as much as I don't like most of them) can't provide sufficient paper work to prove that the debt is legitimate in order to get out of paying a debt you know you owe.

On the other hand, I've had cases where after a creditor or collector agreed to accept less than the full balance due to the severe financial hardship of the consumer, the remaining balance showed up at another collection agency later.

Of course, in that case, you should (and we successfully did) dispute the claim.

I understand that there are many circumstances that happen that may make repayment impossible.

In those cases, if a Debt Management Program or a Debt Settlement Program can help, then a person should take advantage of such programs.

If things are so dire that neither program can help, then Bankruptcy may or should be the only option.

So, for your DO IT YOURSELF CREDIT SCORE CHECK UP:

- Order a FREE Credit Report

- Check for errors

- Gather proof of payment

- Write letters

- Follow up! Follow up! Follow up!

If all of this sounds like TOO MUCH, we can help:

![5101529797_2ec7252b8c_t[1]-resized-600](https://49162.fs1.hubspotusercontent-na1.net/hub/49162/file-14366568.jpg?width=139&name=file-14366568.jpg)

Would you like to know how to improve your credit score?

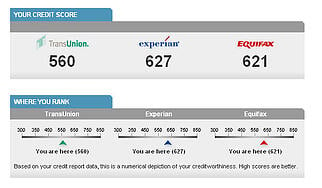

Would you like to know how to improve your credit score? A lady from Portland, Oregon called to ask, "What really determines my credit score?"

A lady from Portland, Oregon called to ask, "What really determines my credit score?"

Looking for Oregon credit repair?

Looking for Oregon credit repair?