If you find yourself unable to pay your bills, about to lose your home, or in a financial hole so deep that you can't climb out of, then it is time to look into filing for bankruptcy protection.

This is the final blog about DEALING WITH DEBT. There are basically 3 ways to deal with debt:

In a bankruptcy, you will eliminate most of your debt or you will be able to schedule a repayment plan that will fit your budget, given your dire financial circumstances.

In a bankruptcy, you will eliminate most of your debt or you will be able to schedule a repayment plan that will fit your budget, given your dire financial circumstances.

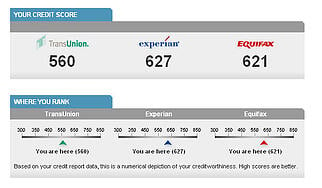

But, bankruptcy comes at a cost of your credit score and possibly some of your assets.

Yes, after you complete your bankruptcy, you can still get credit, but usually the interest rates are higher and the credit limits are lower.

This is why it is so important to gather as much information you can from an experienced bankruptcy attorney. The initial bankruptcy consultation should be free and most bankruptcy attorneys will work with you as to payment of their services and fees.

Individuals filing personal bankruptcy will generally be able to file a CHAPTER 7 or a CHAPTER 13 bankruptcy.

Under normal circumstances, a Chapter 7 bankruptcy will take about 90 to 180 days to complete. A Chapter 13 bankruptcy will take about 3 - 5 years, depending on several factors.

Good news!!!! Once your bankruptcy attorney starts the process, the debt collection calls will stop. If you are not sure if bankruptcy is the best choice for you and would like to put a stop to the debt collection calls, click below:

Individuals or couples with few assets and are looking for a FRESH START, tend to file a Chapter 7 bankruptcy. This type of bankruptcy is basically a liquidation bankruptcy in which a debtor trades all of their non-exempt assets as payment for all of their dischargerable debt. Many, if not all, personal possessions are protected by exemptions and most consumer debt, such as:

- Credit Cards

- Store Cards

- Personal Loans

Individuals or couples looking to catch up on mortgage payments, get rid of 2nd mortgages, or who are ineligible for Chapter 7 bankruptcy, can file a Chapter 13 bankruptcy. A chapter 13 bankruptcy involves making a deal with the court to pay a certain amount of your income to the court each month in return for getting rid of all of your dischargerable debt.

People will choose a Chapter 13 Bankruptcy because there are certain types of debt that only go away in a chapter 13 bankruptcy and, there are certain advantages that can only be had in a chapter 13 bankruptcy. This type of bankruptcy can be used to catch up on mortgage or child support payments. However, there is a danger of not completing your plan and thus not getting a discharge.

Filing bankruptcy does not mean that you will lose your home or your car.

In fact, in some situations, filing bankruptcy will even allow you to keep a car or home that you were about to lose. This is because bankruptcy allows you to protect some or all of your assets with exemptions. These are set amounts of personal property that you can protect during a bankruptcy. Retirement accounts are generally protected as are certain support payments that you may be receiving.

Filing for bankruptcy does not mean that everyone you know will find out!

Only the necessary parties are inform of your bankruptcy filing. Individuals who receive notice of your bankruptcy filing are creditors, co-debtors, and co-owners of shared assets.

A bankruptcy will stay on your credit report up to 8 years, but it will have less effect with each passing year. Filing bankruptcy may hurt your credit score in the short-term, but it allows you the chance to start rebuilding it right away.

Still not sure how to deal with your debt? Get answers by clicking below:

Blog article written by: Noah Bishop of BishopBankrutpcyLaw.com

Photo by:

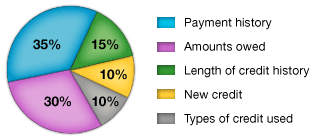

A lady from Portland, Oregon called to ask, "What really determines my credit score?"

A lady from Portland, Oregon called to ask, "What really determines my credit score?" As strange as it seems, closing credit card accounts will actually hurt your credit score.

As strange as it seems, closing credit card accounts will actually hurt your credit score.