If you have ever tried to check and/or improve your credit score, you know it can be pretty confusing. Here are some tips on how you can improve your credit score.

You've probably seen an ad or had a "pop-up" appear on your computer by a so-called "Credit Repair" company offering to increase your credit scores almost "over night"!

My advice...RUN! You've heard the old saying:

"If it sounds too good to be true, it probably isn't true."

Although there are many legitimate companies that will help you improve your credit over time by correcting errors and helping you maintain a disciplined approach to using your credit, there is just no "quick fix" when it comes to improving a bad credit history and therefore a poor credit score.

I have been have been helping people settle and manage outstanding credit debt for over ten years now and I believe that one of the most helpful sites you can use can be found at:

www.MyFico.com

While you cannot improve your score quickly, YOU CAN IMPROVE YOUR CREDIT SCORE over time, by following the following tips:

If you haven't done so already, get a FREE copy of your Credit Report.

We all can get a free copy once a year, so take advantage of this by annually checking your credit report...and it's FREE!

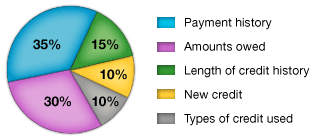

According to Fair Issac or FICO, there are 5 areas that affect your credit score the most:

Paying your bills on time is one of the most important things you can do to maintain a good credit score. Being just a few days late will hurt you score.

If you have had accounts go to a collection agency, then that obviously will hurt you score. By-the-way, if you pay off or settle an account with a collection agency, it will remain on your credit report for up to seven years, but the fact that you paid the debt will ultimately help your credit score.

Using a Debt Management Company to help you get control of your debt can be very helpful.

No, your credit score will not be affected by using or not using a Debt Management Company, but in the long run, the professional help and guidance will help reduce or pay off all of your debt and therefore, improve you credit score.

Next, notice that at least 30% of your credit score is determined by the AMOUNT OF DEBT you owe.

A lot of people think that just because they have never been late on a payment they should always have a great score. But, if they have a very large amount of debt in relation to their income and total available debt, they will be disappointed with their score.

Here's basically why:

Let's say that you are a credit card company and are considering offering or issuing credit to these two prospects:

Prospect #1 has a good job and employment history. She in never late on making her payments for her mortgage, car and all of her credit accounts. But, even though she is earning a "better-than-average" income, she has accumulated over $30,000 of unsecured debt in addition to her mortgage and auto payments!

She would need to be making minimum payments of $750-$850 per month on her unsecured debts (credit cards, store cards, etc.) and that equates to about 25% of her net monthly take-home income just for these unsecured debts. When you add in a $1200 mortgage and a $400 car payment, that's about $2,400 per month going out to service her DEBT!

Even with her "better-than-average" job and income at say, $75,000 annually, when you take out 30% for taxes and other deductions, that gives her a net monthly income of about $4,375. With $2400 going out to just meet the minimum payments on all of her debt, that equates to almost 55% of her net income!

One "hick-up" such as long illness, loss of job, or any other hardship would make it almost impossible for her to meet your debt payment obligations. If you were a credit card company, would you loan her more money? Hence her credit score is not as high as she though it would be.

How about Prospect # 2:

He had a good job and earns about $4,000 per month. Not that much really, but he is doing OK. He isn't buying a home and so is paying about $800 per month in rent.

His old truck (not too old...maybe 8-10 years) is paid for. Although it doesn't get great gas mileage, at least he doesn't have a big payment each month.

He has a good credit history and although maybe late a couple of times in the past, he has maintained a steady, on-time history for several years now.

He has about $10,000 on 3 credit cards which demands that he makes at least a minimum payment of $215 each month, which he does and sometimes adds a little more than the minimum.

Another VERY IMPORTANT PART OF DETERMINING YOUR CREDIT "WORTHINESS":

The ratio of credit being used to the availability of credit to you.

He has paid off several accounts in the past and actually has about $40,000 of available credit (credit limits on all of his accounts) that he could use if need be.

He is only using $10,000 of the available $40,000 or only 25%. This is considered a good use of available credit and so he would be viewed as a better credit risk.

Are you starting to get the idea? It's not just about paying your accounts on time (although that is certainly important), but more about USING AND MAINTAINING YOUR CREDIT WISELY!

You will notice that the LENGTH OF CREDIT HISTORY makes up at least 10% of your credit score. If you are just starting out and have not established much of a credit history, DO NOT MAKE THE MISTAKE OF OPEINING A LOT OF ACCOUNTS IN A SHORT PERIOD OF TIME!

Opening too many accounts too fast doesn't look good to the credit bureaus. In fact, it could do more harm than good! Just open an account or two, make some small charges and pay them off promptly.

How long will this take? It depends on some and/or all of the other factors we've been talking about. The point is that establishing good credit doesn't happen quickly.

One more thing...

Closing accounts doesn't help improve your score! In fact, it will probably hurt your score.

Why?

Again, you want to show that you are a responsible user of credit over a long period of time. If you close too many accounts (assuming a $0 balance on them), you are reducing your "credit-use-ratio" as we discussed before.

Pay off and/or settle old accounts the best you can. Sometimes it makes sense to seek the help of a professional Debt Management Company to settle old debts that have been around for a long time.

Sometimes these can be removed (using the proper procedure) from you credit report if they have gone past your state's statute of limitations.

Debt Settlement can help if you are in over your head!

To summarize, the best way to improve your credit is too:

- Manage your credit wisely...not too much...too fast!

- Make your payments on time. Being a day late hurts more than you know. Try using "auto-payments".

- Check that Credit Report for errors! All three credit bureaus will let you go on line to dispute errors. You don't have to pay someone else if you will take a little initiative.

- Finally, although I don't suggest closing credit card accounts, I do believe that you should only use one card for emergencies only! Pay cash or don't buy! Saw this sign in the parking lot of a major retailer the other day and it really says it all:

The best way to improve your credit score???? Use credit wisely.

Photo credit: http://www.myfico.com/CreditEducation/WhatsInYourScore.aspx