If you are having a hard time increasing your credit score, there may be some good news on the horizon!

Major credit reporting company Fair Isaac (FICO) has been pressured by Washington to change its credit-risk scoring model to give a break to consumers that have had debt turned over to collection agencies!

While this "change" to the basic credit score scoring model is still in the works, it could be a seen as a great idea to consumers, while at the same time, another dangerous, slippery slope by lenders.

Recently, I've reviewed a few articles recently about the changes may be coming to credit reporting agencies. One of the best was from Paul Sperry for Investor's Business Daily. I highly recommend you checking out Mr. Sperry's article.

For years, those unfortunate people who for reasons usually beyond their control, found themselves with too much debt and not able to make payments, saw their accounts charged off by the creditors and turned over to a collection agency.

If you've read any of my blogs in the past, you know what I think about most collection agents and agencies.

While there are a lot of debt collection companies out there that are professional and stay (for the most part) within the Fair Debt Collection Practices Act (FDCPA), as with any group or organization, there are always a few "bad apples".

It seems that the Consumer Financial Protection Bureau (CFPB), created by the Obama administration, has been in talks with the Fair Isaac company to "ease up" on some of the weight they give information about your credit to determine your credit score.

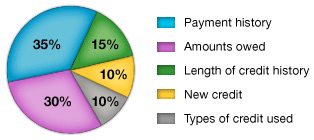

Currently, FICO uses the following guidelines (along with a lot of othe information) to produce a credit score:

As you can see, your payment history is worth 35%, so if you have had debt issues in the past and have had some or all of your accounts go to a collection agency, your credit score would suffer.

However, under the proposed new guidelines "suggested" by the Consumer Financial Protection Bureau, FICO would no longer penalize your credit score because of delinquent MEDICAL DEBT or ANY DEBTS THAT GO TO A COLLECTION AGENCY THAT GET'S REPAID!

To me, that is great news!

In dealing with people over the last dozen years or so, I would say that the greatest majority of people who wound up in a severe debt situation, did so due to circumstances beyond their control, with MEDICAL DEBT being one of the largest debt!

It's not unusual to see someone with $10,000, $20,000 or more of medical debts. When you see the (in my opinion) OUTRAGEOUS MEDICAL FEES charged by some doctors and hospitals, it's no wonder that people get into trouble.

If these people can find some relief to their credit score by making some changes to the way a credit score is calculated, then I'm all for it!

I like what the article said, "Obama regulators argue that it's important to insulate consumer credit scores from medical debt, for one, because such bills are "unexpected".

Another important and much needed action by the CFPB was that they released a report (2012) that basically stated that less than 80% of credit reports were accurate.

Inaccurate information on your credit report can really hurt. The good news is that you can challenge mistakes and get the credit reporting bureaus to change your report, thereby increasing your credit score and/or credit worthiness.

Click here to get a FREE COPY OF YOUR CREDIT REPORT.

If you find yourself with too much debt, or just overwhelmed by all of this, we may be able to help:

Photo Credit: lendingmemo.com

Photo credit: http://www.myfico.com/CreditEducation/WhatsInYourScore.aspx